You can learn more concerning the standards we follow in generating exact, impartial web content in oureditorial plan. A jumbo home mortgage is usually for quantities over the adjusting car loan restriction, $548,250 in 2021 and $647,200 in 2022 in a lot of the U.S . The 2021 optimum adhering loan limitation is $822,375 and $970,800 in 2022.

- There are a couple of aspects to consider when it involves obtaining the right home loan.

- Home loan lenders are still offering historically reduced prices to good debtors.

- You'll have a yearly overpayment allocation for fixed-rate home mortgages equal to 10% of the impressive equilibrium of your mortgage.

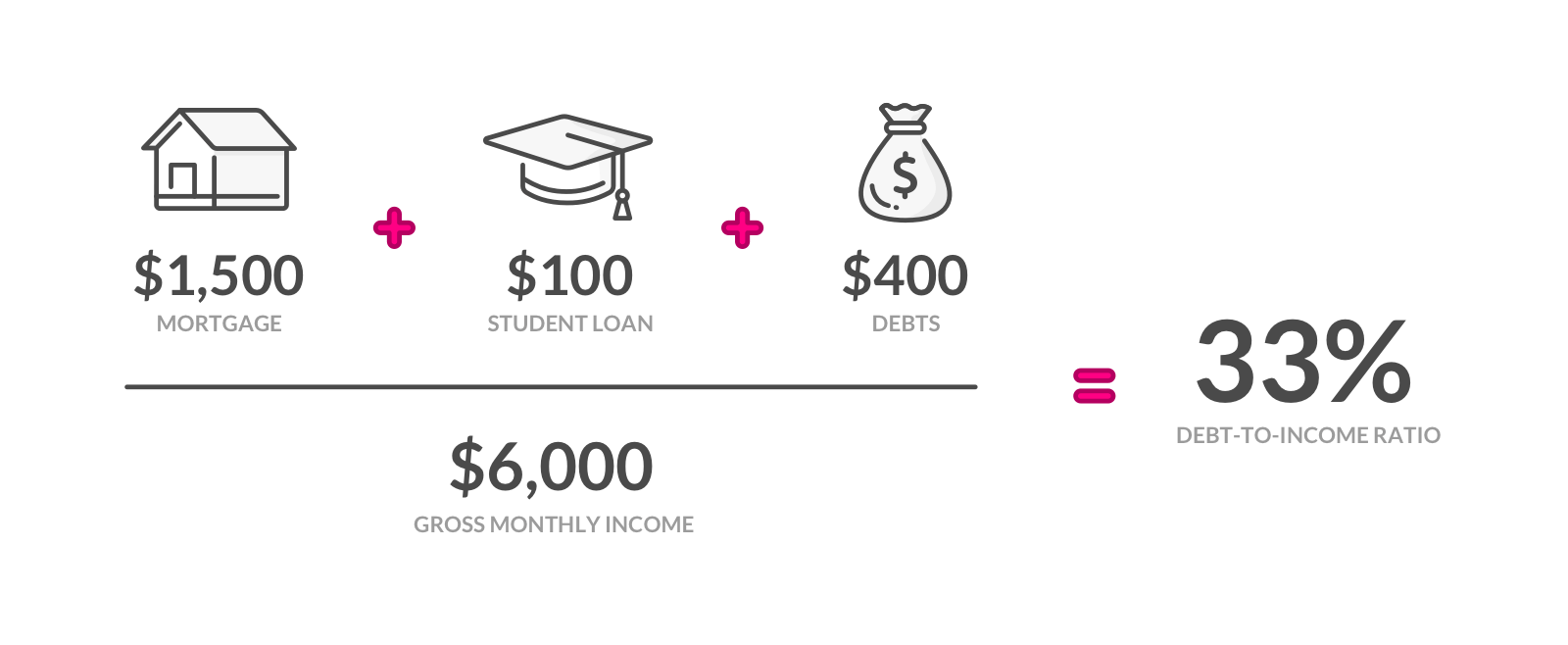

- Your individual monetary info-- consisting of credit rating, debt-to-income ratio and also revenue history-- also have a significant influence on interest rates.

- This is the preliminary portion price at which we compute the interest on the home loan.

- Tracker prices relocate directly in line with an additional interest rate-- usually the Bank of England's base price plus a couple of percent.

It's expressed as a percent, and if it's repaired, it will never change. Adjustable home loan prices are taken care of for a minimal quantity of time, maybe 3-10 years, and afterwards normally reset yearly after the introductory duration. APR, or annual percentage rate, is a computation that consists of both a funding's rates of interest and a lending's financing fees, shared as an annual expense over Donating Timeshare To Nonprofit the life of the car loan. Jumbo rates are for financing quantities exceeding $548,250 ($ 822,375 in Alaska as well as Hawaii). Conforming Fixed-Rate Loans - Conforming prices are for lending amounts not surpassing $548,250 ($ 822,375 in AK as well as HELLO).

With a Funding Price quote from each loan provider compared side-by-side, you'll be able to see which lender is offering you a great mortgage price combined with the lowest origination charges. Don't obtain a vehicle loan, make large acquisitions on your charge card, or apply for new charge card in the months before you intend to buy a house. Doing so can lower your credit score, as well as increase the rate of interest lenders are most likely to charge you on your home loan.

Exactly How Home Loan Settlements Are Computed

Types of credit history charge card, pawnbrokers, house credit score, shop and catalogue cards and also overdraft accounts. The last day of closing is when you'll authorize the dotted line, take the tricks to your brand-new house, and also formally have a home mortgage. 3 Non-cumulative and does not use if you prepay completely. Investopedia requires writers to make use of main sources to sustain their work. These consist of white papers, federal government data, initial reporting, and also interviews with sector specialists. We additionally reference original study from other reliable publishers where ideal.

The APR, or annual percentage rate, is expected to show a more accurate cost of loaning. The APR computation includes charges as well as discount rate points, along with the rate of interest. The Federal Book does not established mortgage prices, yet it does influence home loan prices indirectly. It guides the economic climate with the twin goals of encouraging work development while maintaining inflation under control. Decisions made by the Federal Competitive Market Board to elevate or reduce short-term rate of interest can sometimes create lending institutions to raise or cut home mortgage prices. Typically, each regular monthly repayment includes concerning one-twelfth of the yearly expense of real estate tax as well as home owners insurance policy.

The cost to obtain cash revealed as Best Timeshares To Purchase a yearly percentage. For mortgage, excluding house equity credit lines, it consists of the rate of interest plus various other fees or costs. For residence equity lines, the APR is just the rate of interest.

Whats The Distinction In Between Apr And Also Rate Of Interest?

Home mortgage debt companies refers to non-MFIinstitutions that have authorisation from Finansinspektionen to provide mortgages. Typically, home mortgage credit rating business sell What Is The Average Cost Of A Timeshare the mortgages to alternate investment funds. The AIFs included in the economic markets data are connected to mortgage credit history business, as well as whose assets mostly consist of home mortgages. Unless or else specified, the analytical information describes MFIs. If the CIBC Prime rate goes down, even more of your settlement goes to the principal. If the rate rises, even more of your repayment goes to passion.

With an interest rate of 2.57%, you would pay 670 per month in principal and interest for each $100,000 obtained. Over the life of the finance, you would pay $20,616 in complete rate of interest. Home mortgage rates increased today, yet if you want buying a house or refinancing your present home, you still have a shot at locking in a historically reduced rate.

Once you prepare to begin contrasting lending deals, send an application. Until you use, the lender will not have the ability to offer you an official quote of the charges as well as rate of interest you qualify for. Taking a look at the finances and programs that banks, cooperative credit union, and brokers offer will assist you comprehend every one of your choices. Some charges might be charged each year or monthly, like exclusive home loan insurance.